Little Known Facts About Estate Planning Attorney.

Little Known Facts About Estate Planning Attorney.

Blog Article

Estate Planning Attorney Can Be Fun For Everyone

Table of ContentsLittle Known Questions About Estate Planning Attorney.Get This Report on Estate Planning Attorney7 Easy Facts About Estate Planning Attorney ShownThe Best Strategy To Use For Estate Planning Attorney

Estate preparation is an activity plan you can utilize to identify what takes place to your possessions and obligations while you live and after you pass away. A will, on the other hand, is a legal paper that lays out just how possessions are dispersed, who looks after youngsters and pet dogs, and any kind of various other desires after you pass away.:max_bytes(150000):strip_icc()/estate_planning_shutterstock_525382207-5bfc307846e0fb00517cd38d.jpg)

The executor also needs to pay off any tax obligations and financial obligation owed by the deceased from the estate. Creditors normally have a restricted amount of time from the date they were alerted of the testator's fatality to make insurance claims versus the estate for cash owed to them. Insurance claims that are denied by the executor can be brought to justice where a probate judge will have the last word as to whether the case is legitimate.

The Single Strategy To Use For Estate Planning Attorney

After the supply of the estate has actually been taken, the worth of assets calculated, and tax obligations and financial obligation repaid, the executor will certainly after that seek permission from the court to disperse whatever is left of the estate to the recipients. Any kind of estate taxes that are pending will certainly come due within nine months of the date of fatality.

Each specific locations their assets in the count on and names a person apart from their spouse as the recipient. However, A-B trusts have come to be less preferred as the inheritance tax exemption works well for the majority of estates. Grandparents might transfer possessions to an entity, such as a 529 strategy, to support grandchildrens' education.

8 Easy Facts About Estate Planning Attorney Explained

Estate planners can deal with the contributor in order to lower taxable earnings as an outcome of those payments or formulate techniques that make the most of the impact of those contributions. This is one more approach that can be utilized to limit death tax obligations. It involves a specific securing in about his the current worth, and thus tax obligation responsibility, of their building, while associating the value of future growth of that capital to one more individual. This approach involves cold the value of a property at its worth on the date of transfer. Appropriately, the amount of prospective capital gain at death is additionally iced up, allowing the estate coordinator to approximate their potential Visit This Link tax obligation liability upon fatality and better plan for the repayment of revenue taxes.

If adequate insurance earnings are readily available and the plans are properly structured, any kind of earnings tax obligation on the deemed dispositions of possessions complying with the fatality of a person can be paid without resorting to the sale of possessions. Profits from life insurance policy that are received by the beneficiaries upon the death of the insured are typically revenue tax-free.

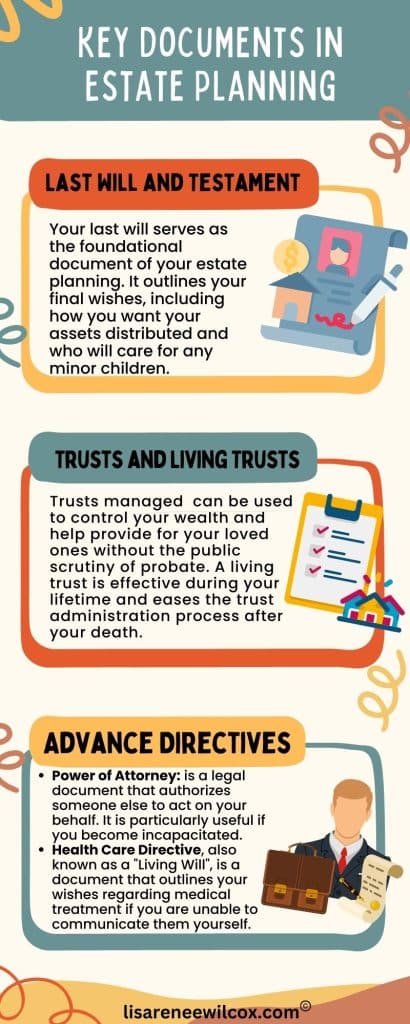

There are certain papers you'll need as part of the estate planning procedure. Some of the most usual ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is only for high-net-worth people. Yet that's not real. Estate planning is a tool that everyone can make use of. Estate preparing makes it much easier for individuals to determine their dreams prior to and after they die. Unlike what most individuals believe, it prolongs beyond what to do with assets and liabilities.

The Greatest Guide To Estate Planning Attorney

You must start preparing for your estate as soon as you have any type of quantifiable asset base. It's a continuous procedure: as life advances, your estate strategy ought to change to match your scenarios, in line with your new objectives. And maintain it. Not doing your estate planning can create undue monetary worries to loved ones.

Estate preparation is usually assumed of as a device for the well-off. Estate preparation is additionally a wonderful means for you to lay out strategies for the treatment of your minor kids and animals and to describe your desires for your funeral and favored charities.

Applications should be. Qualified candidates who pass the examination see it here will certainly be formally certified in August. If you're qualified to rest for the test from a previous application, you may file the brief application. According to the regulations, no accreditation will last for a duration much longer than five years. Find out when your recertification application is due.

Report this page